A Few Simple Truths about Health Insurance

Health insurance is a necessity to live long, healthy

One important step in our atmasvasth quest is health insurance. You may never need it, but as we grow older and the uncertainty around major illnesses increases, it is important to have the means to cover the expenses and costs involved, which can often be catastrophic and adequate health insurance helps us absorb these financial shocks.

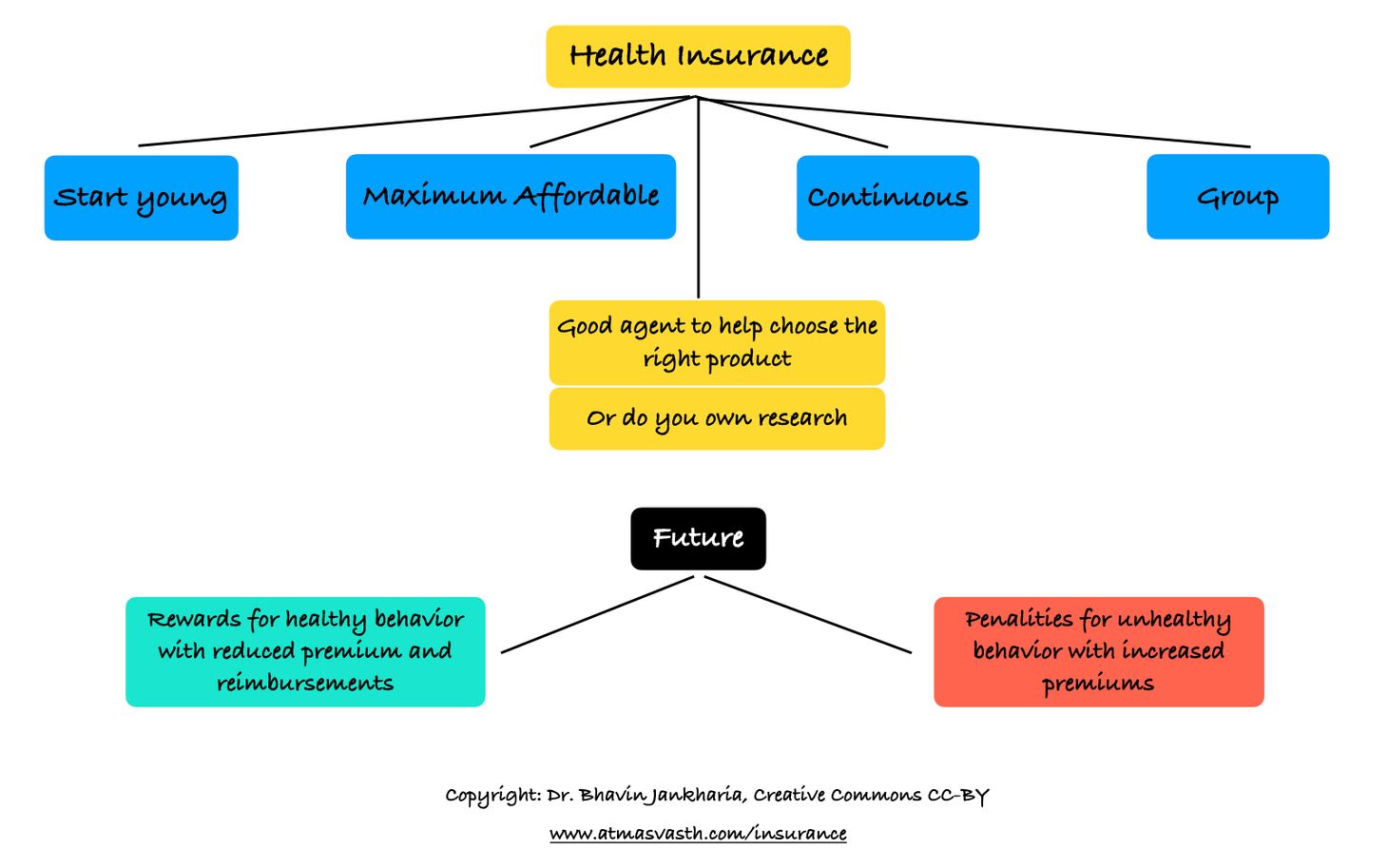

You will need to do your own research to find the best product that suits your needs and it may perhaps be simpler to find a trusted agent to do this for you, who can then also help and guide you later with the paperwork, if and when you fall sick and need to use the insurance.

There are however some simple truths.

1. Buy the maximum health insurance you can afford.

2. The day you think of health insurance is the best day to buy.

3. Start buying health insurance at the earliest age you can.

4. Go with a group insurance plan…invariably there is better cover.

(Free to read, but to read more, please subscribe with your email)

With help from Dr. Sandeep Dadia and Mr. Nayanesh Mehta.

One important step in our atmasvasth quest is health insurance. You may never need it, but as we grow older and the uncertainty around major illnesses increases, it is important to have the means to cover the expenses and costs involved, which can often be catastrophic and adequate health insurance helps us absorb these financial shocks.

You will need to do your own research to find the best product that suits your needs and it may perhaps be simpler to find a trusted agent to do this for you, who can then also help and guide you later with the paperwork, if and when you fall sick and need to use the insurance.

There are however some simple truths.

1. Buy the maximum health insurance you can afford.

2. The day you think of health insurance is the best day to buy.

3. Start buying health insurance at the earliest age you can.

4. Go with a group insurance plan…invariably there is better cover.

For example, as a specialist doctor and a member of the Association of Medical Consultants (AMC), I have group insurance with the AMC. My 85-years old father, who is also a doctor, my mother, and my entire family, are all insured through the AMC, which also takes care of the paperwork when it comes to claims. This makes a huge difference.

Similarly, in my own medical practice, all our employees who have spent a certain amount of time with us, have free group health insurance through our practice. For Jains, for example, there is a Jain group health insurance available through one of the Jain foundations and so on and so forth.

It is sad when I see a patient above the age of 65 groveling for discounts, simply because they forgot or consciously decided not to take health insurance when young and when they finally did decide to apply for the first time after the age of 60 years, found themselves largely ineligible. I can understand people who are uneducated and/or do not have the means, not having health insurance (and even they have the PM-JAY to fall back upon), but educated people with money being without health insurance is nothing but sheer stupidity, unless you are so rich, that health costs just don't matter. The simple rule is that if you have continuous health insurance from a young age, then you will be able to continue to have health insurance till you die, even if you become a centenarian. However, if you haven’t had continuous health insurance earlier, then you may never be able to get one, if the first time that you apply is when you are over 60 years of age.

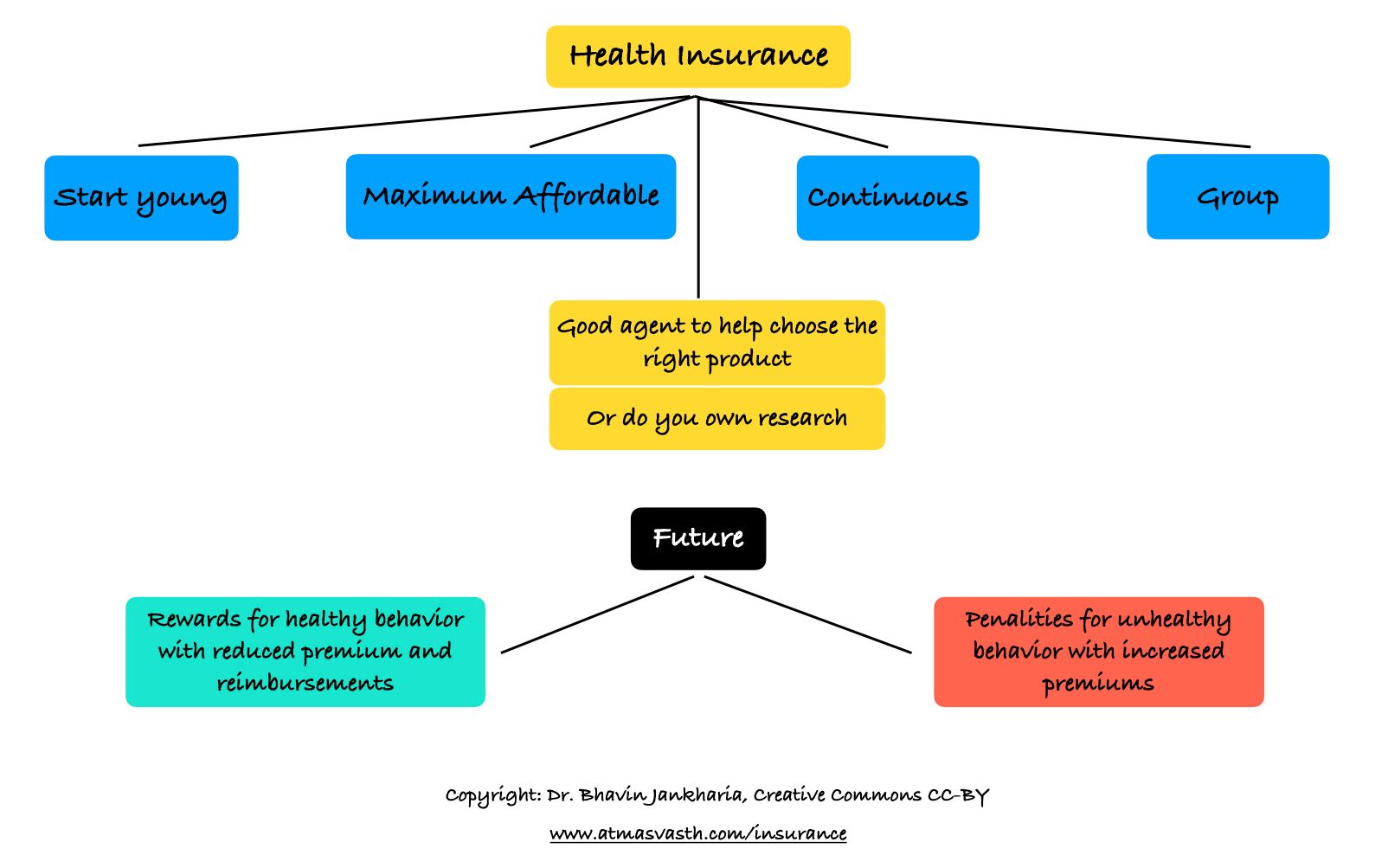

The health insurance industry is still a baby. The insurance policies we have today are crude, blunt tools, where you need to get sick to be paid money to cover your expenses. There is currently no reward for being healthy and not getting sick, apart from the fact that your premiums don’t increase the following year as much as of those who have used their health insurance.

In the future, insurance companies will need to work with actuaries to develop risk models that reward those who take the effort to live healthy and penalise those who don’t. This cannot be difficult and we are already seeing some efforts in that direction.

For example, those who show evidence of working out at least 30 minutes, 5 days a week, have a blood pressure below 120/70, an LDL not more than 70 mg/dl, an HbA1c less than 5.6, who don’t smoke or drink or drink very mildly, if at all, keep calories in check, eat a plant-based diet with adequate fruits, vegetables and nuts (yes, all of these can be tracked) should have to pay much less insurance premium than those who don’t follow these basic health rules and in fact those who demonstrate healthy behavior should be reimbursed anywhere from 20-50% of their insurance premium for staying healthy, while those with unhealthy behavior patterns should be asked to cough up more, both at the end of the year and when they have to pay for the next year’s premium, even if there is no claim. Otherwise, currently, the healthy are underwriting the costs for the sick.

Healthy behavior must be rewarded and unhealthy behavior must be penalised…this will go a long way in motivating people to adopt measures, like the 13-points atmasvasth guide, to live long, healthy.

Employers should also do the same and give more bonuses or extra money to those who make an effort to be healthy and penalize those who don’t. It is in the interest of the company to have healthy employees, who work harder and better and who would eventually cost the company less in medical expenses.

So the bottom line is this…get health insurance today, if you don’t have one, get the maximum cover you can afford, for yourself and for those around you and if possible, get into a group insurance. Now. ASAP. Today. Abhi-ke-abhi.

Atmasvasth Newsletter

Join the newsletter to receive the latest updates in your inbox.